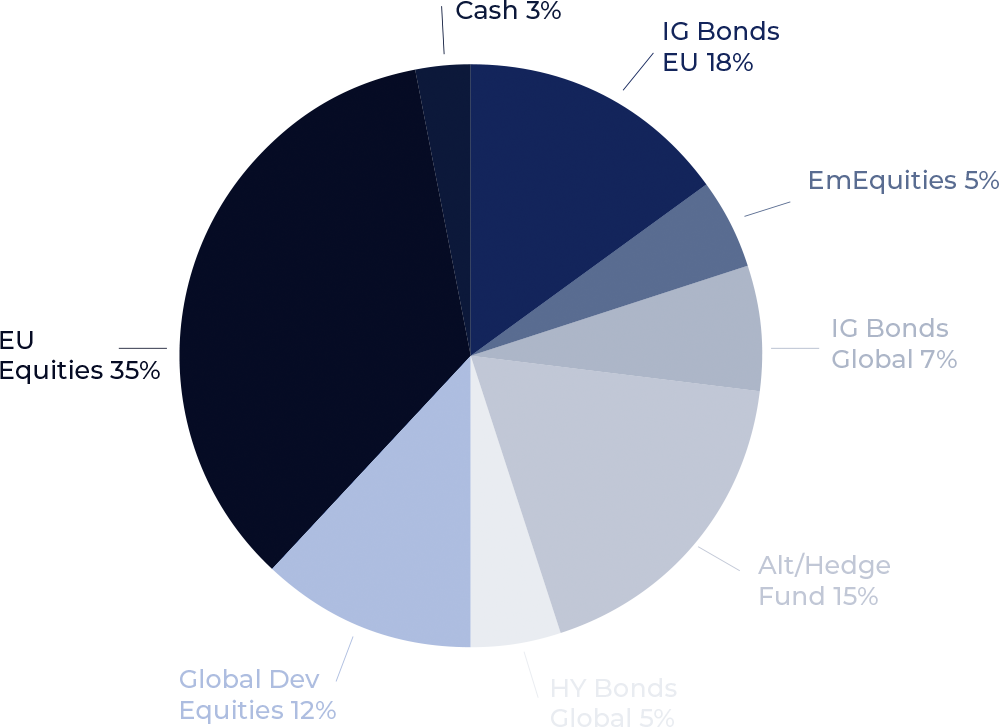

We provide highly personalised wealth management services to individual and institutional clients. We are independent and 100% transparent: we choose the investment we consider best for you not the ones giving intermediaries the highest fees.

Independent

No pressure to sell specific investment products

Transparent Fees

100% transparent fees – nothing hidden

Qualified & Experienced Team

PhDs and Actuaries with extensive market experience

EU Regulated

Registered with all the main EU regulators